A Michigan court found General Motor’s disability plan failed to do a full and fair review for an engineer suffering from mental health conditions.

Background of the Case

Kristne Fitzgerald worked for General Motors (“GM”) as a senior performance engineer until she became disalbed due to depression, anxiety and ADHD. Under the General Motors Life and Disability Benefits Program for Salaried Employees, Ms. Fitzgerald was paid for sickness and accident benefits. Once those benefits were exhausted, she filed for extended disability benefits. She submitted her claim form for extended disability benefits on April 3, 2018.

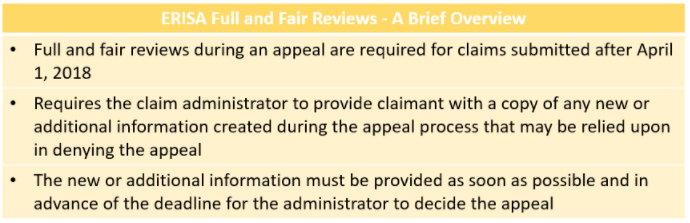

Because this is a group disability plan offered by an employer, it is governed by the Employee Retirement Income Security Act (“ERISA”). ERISA regulations were amended, effective April 1, 2018, to require a disability insurer or plan administrator to conduct a full and fair review of an appeal of the denial of benefits.

ERISA Regulations Require a Full and Fair Review of an Appeal

Under the full and fair review requirement, a disability plan or insurance company must provide any new or additional include that it may rely on to deny a claim to the claimant with an opportunity to review and respond to it. The GM plan did not do this.

Instead, it simply referenced an adverse medical review in its denial letter as the basis for denying the appeal. This was the first time Ms. Fitzgerald learned of the adverse medical review done by GM.

The Court then determined that GM did not conduct a full and fair review and thus violated ERISA regulations. As a result, the Court remanded the claim back to the Plan Administrator to further investigate the claim and determine if Ms. Fitzgerald is disalbed under the terms of the plan.

The attorneys at Daboud Law Firm are no strangers to the full and fair review requirement with disability appeals. We work hard to ensure that the plan administrator or disability insurance company is held accountable under ERISA regulations.

Attorneys That Specialize in Handling Your Disability Insurance Claims

This law firm was created with a single purpose in mind: to help people get disability benefits from insurance companies.

With that kind of focus, we have:

- Experience with every disability insurance company

- A proven track record of success by winning major long term disability lawsuits;

- Recovered millions of dollars in disability benefits for clients like you;

Every day, our disability lawyers work to get insurance companies to approve long-term disability claims or appeal disability benefits denials.

With so much at stake, shouldn’t you have expert disability lawyers on your side?

Because federal law applies to most disability insurance claims, we do not have to be located in your state to help.

Call to speak with a disability insurance lawyer – call us at (800) 969-0488 or contact us online. Consultations are free.