It depends. Taking your pension may or may not reduce your monthly long-term disability payment.

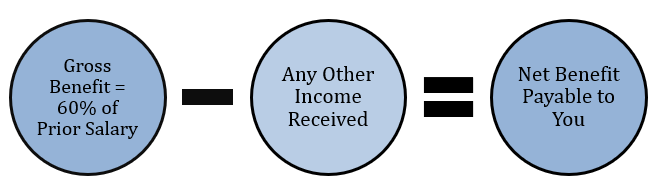

If you are found to be disabled, your insurance company will award you a monthly disability payment. The payment is based on a percentage of your pre-disability monthly earnings, typically around 60% of your prior salary. However, most long-term disability policies contain offsets, or reductions, for other income received.

The long-term disability policy will define other income and what amounts can be reduced from your monthly payment. Typically, this includes social security disability payments (SSDI), worker’s compensation benefits, personal injury settlements, and sometimes retirement benefits.

Our experienced disability attorneys can advise you on whether your pension is considered an offset and any consequences associated with taking such a pension.

Attorneys That Specialize in Handling Your Disability Insurance Claims

This law firm was created with a single purpose in mind: to help people get disability benefits from insurance companies.

With that kind of focus, we have:

- Experience with every disability insurance company;

- A proven track record of success by winning major long term disability lawsuits;

- Recovered millions of dollars in disability benefits for clients like you;

Every day, our disability lawyers work to get insurance companies to approve long-term disability claims or appeal disability benefits denials.

With so much at stake, shouldn’t you have expert disability lawyers on your side?

Because federal law applies to most disability insurance claims, we do not have to be located in your state to help.

Call Dabdoub Law Firm today at (800) 969-0488 to speak with an experienced attorney about your case.