Long-term care insurance policies are designed to help individuals cover the costs of long-term care services, including those received in a nursing home, assisted living facility, or in-home care.

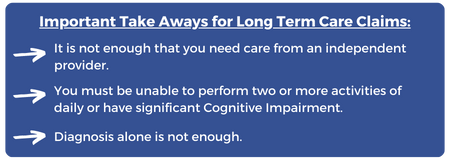

Long-term care insurance policies require that claimants meet certain criteria before benefits are payable. Typically, you must meet the definition of chronically ill as defined by the long-term care insurance policy in order to qualify for long-term care benefits.

What does it mean to be chronically ill?

Generally, there are two ways you can meet the definition of chronically ill:

- You are unable to perform a certain number of activities of daily living (ADLs) without assistance;

- Activities of daily living can include:

- Eating;

- Bathing;

- Continence;

- Dressing;

- Toileting; or

- Transferring

- Activities of daily living can include:

- Significant cognitive impairments make it so you require supervision to protect you or others from threats to health and safety.

Diagnosis by itself does not equate to chronic illness. You have to prove that your medical issues rise to the level of chronic illness. This is where we can help.

Dabdoub Law Firm is a law firm that specializes in representing individuals with long-term care insurance claims. The attorneys at Dabdoub Law Firm are highly experienced in navigating the complex issues involved in long-term care insurance claims. We understand the challenges that individuals may face when trying to get their claims approved and can provide effective legal representation to help ensure that you receive the benefits you are entitled to.

We can help you gather the right type of evidence to give you the best chance to receive your long-term care insurance benefits. This includes:

- Coordinating an in-home assessment to prove you need assistance with activities of daily living;

- Coordinating a comprehensive neuropsychological evaluation to assess your cognitive abilities;

- Gathering updated medical records; and

- Assisting in gathering letters/questionnaires from treating providers

If you require assistance or supervision because of medical ailments, you may qualify for long-term care insurance benefits. Contact the attorneys at Dabdoub Law Firm to discuss how we can help you with your long-term care claim. We can help you better understand your policy and the criteria required to receive your benefits.

Help from a Lawyer with Expertise in Long-Term Care Insurance

Long-term care insurance law is complex. Hiring an experienced long-term care insurance attorney is important. Because all lawyers at this law firm focus on long-term care claims, we have experience in long-term care insurance cases.

That means we have:

- Experience with every major long-term care insurance company;

- A proven track record of success;

- Helped many clients receive long-term care insurance benefits;

And, we never charge fees or costs unless our clients get paid.

The firm can help at any stage of your long-term care insurance claim, including:

- Submitting a long term care insurance claim;

- Appealing a long term care denial;

- Negotiating a lump-sum settlement; or

- Filing a lawsuit against your long term care insurance company.

Call to speak with an experienced disability attorney. Consultations are free.